The below is an extract from the breakfast talk at SMU on 27 February 2015 Guest speaker Song Seng Wun of CMIB and Professor of Accounting SMU

Budget 2015 Building Our Future Strengthening Social Security

Global economy is still facing headwinds

Singapore Property Market is undergoing a correction A further 15% downside is likely over the next few years. If you have to sell, sell now, otherwise keep it as Singapore has limited land, Property price will trend up in the longer term

Singapore FY2015 Budget in Summary

Corporate Tax Rate of different countries Singapore is only 0.5% higher than Hongkong

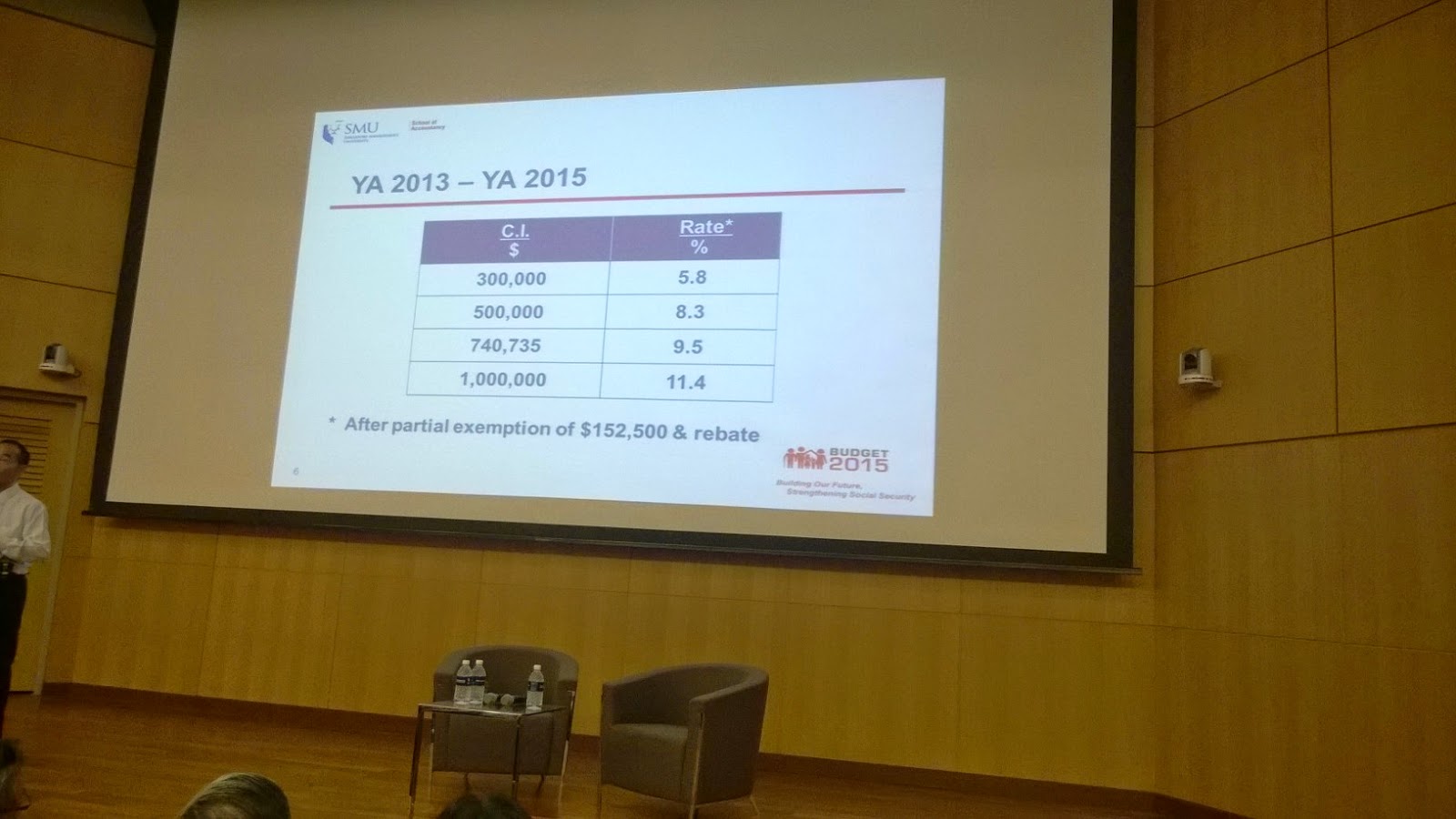

Corporate Tax Rate 2013 to 2015

Comparison of Corporate Tax in Year 2015 & Year 2016 taking into consideration the 30% rebate and cash conversation

PIC Scheme Introduced in 2012

2015 Cash Conversion $700,000

PIC Reconciliation

2015 Cash Conversion $500,000

PIC Reconciliation

2016 Cash Conversion $700,000

PIC Reconciliation

2016 Cash Conversion $500,000

PIC Reconciliation

Personal Tax computation for Assesable Monthly Income of $5000 with 4 months bonus Only pay an effective tax rate of 1.24%

Effective Personal Tax Rate for different countries Singapore only 7.9%

Personal Tax Rate Comparison for 2014 & 2015 The high earner of say $350,000 only pay an extra $2000 in income tax

Rental Income Deduction with effect from year 2016

CPF Contribution Rate as from 1 January 2015 for different age group The highest increase come from age 50 to 55 with a total 2% increase

SUMMARY

In Summary what the above means to Singaporean as an Employee and Businesses as an Employer and the self employed, trades contractor :

For the employee and those below 55 years old and earning less than 26,000 and staying in public housing, will receive the maximum goodies like GSTV and S&C rebates, children school fees waiver, maid levy etc

For those earning $6000 now will also see a sudden increase in their salary though it goes to their CPF

For the elderly poor, finally they are appreciated for their contribution. They will receive $400 to $750 on every 4th month apart from GSTV and bonus payout of $900 These will help them alot.

For the trades contractor, real-estate agents, taxi drivers etc, the increase in petrol will impact their earning further. This group will suffer more as the market is already sluggish.

For SME this will translate to increase in operation and HR cost in the already tough competitive slowing market situation now, this will cause them to prefer employing more foreign talents or those in the 20s and of salary less than $5000.

For MNC the operation and HR cost will increase, profit further dampen with the already slowing economy

For civil servants, the increase in cost in their operation and HR budget will mean they need to take more from the tax payers money to fund the increase.

For majority of Singaporean this budget is nothing to cheer about. In fact we will see an increase in cost of living as cost will pass down to consumers

Refer to the below article extracted from http://mothership.sg/2015/02/everything-you-need-to-know-about-dpm-tharmans-budget-speech-2015-in-90-seconds/

Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam delivered the Budget statement 2015 “Building our Future, Strengthening Social Security” at 3.30pm in Parliament.

The Budget is expected to record a deficit of $0.1 billion for FY2014, smaller than estimated $1.2 billion mainly due to increase in motor-related revenues.

Budget 2015 is focused on building Singapore’s future. It takes major steps in four areas (see graphic from Ministry of Finance below):

Key Points of DPM’s Budget Statement:

1. What is SkillsFuture? It will help Singaporeans with their lifelong learning, through internship programmes, education credits and career guidance.

2) Skills Future Credit : All Singaporeans aged 25 and above will receive an initial credit of $500 for work skills-related courses from 2016. There will be an online resource for a one-stop education, training and career guidance.

Beyond the SkillsFuture Credit, the Government will support Singaporeans seeking to develop skills in particular fields through the three initiatives: SkillsFuture Study Awards, SkillsFuture Fellowships and the SkillsFuture Leadership Development Initiative.

Continuing the restructuring of Singapore’s economy:

i) The Transition Support Package (TSP): To give businesses more time to adjust to rising costs as they restructure, with TSP being phased out gradually.

It has three parts: the Wage Credit Scheme (WCS), Corporate Income Tax (CIT) Rebate, and the Productivity and Innovation Credit Bonus (PIC Bonus).

ii). Managing the foreign workforce growth: The Government will defer this year’s round of announced levy increases for every sector, for S Pass and Work Permit Holders. Foreign workforce growth, excluding Construction, has slowed significantly from 60,000 in 2011 to just over 16,000 in 2014. In construction, foreign worker growth in 2014 was around 10,000, far below that recorded in the previous two years.

3. Assurance in retirement: There are two sets of measures to strengthen savings and income in retirement – enhancements to the CPF system and the introduction of the Silver Support Scheme (SSS).

i) Enhancements to CPF system: i) Increase CPF Salary ceiling to $6,000 from 2016; ii) Raise CPF Contribution Rates for older workers; and iii) Extra CPF interest for all CPF members 55 & above.

ii) Silver Support Scheme (see below)

4. Help for Education: i) Account top-ups for young S’poreans; ii) Full fee wavier for exams (PSLE, ‘N’, ‘O’ & ‘A’ level exams, poly and ITE exams; and iii) Support for Needy students – additional $6 million grant to self-help groups

5. Help for Households: i) Foreign Domestic Worker Concessionary Levy reduced to $60 per month; ii) GST Vouchers; and iii) One-off rebate for Service & Conservancy Charges.

6. Foster a spirit of giving: i) Government will donate $20,000 to each school to use for the causes that they identify. This initiative will be extended to Polytechnics and ITE, for which the Government will donate $150,000 and $250,000 respectively; and ii) Government will increase tax deduction rate to 300% for 2015 for donations.

7. Vehicle-related taxes: i) Increase in Petrol Duty rates by $0.15/$0.20 per litre from 23 Feb 2015; and ii) One-year Road Tax rebate

8. Personal Income Tax (PIT): i) Increase top marginal tax rate from 20% to 22% for chargeable income above $320,000 and ii) Increase marginal tax rates for chargeable incomes above $160,000 to $320,000 by 1 to 2%.

No comments:

Post a Comment